It may seem too good to be true, but the Student Loan Benefit Program is really going to help you pay down your student debt! You worked hard to get through school and pay your loans. Now it’s time for a little help.

|

How the Student Loan Benefit Program Works

For employees who are eligible for the Student Loan Benefit Program (the “Program”) and sign up to participate, Phillips Infrastructure Holdings will make payments directly to the employee’s selected eligible loan service provider. Only one loan at a time may be selected by the employee for a payment under this Program.

This payment is an additional payment designed to help employees pay their loans off faster and save on interest; employees are expected to continue making the minimum monthly payments to their loan service provider even if their monthly payments are less than Program monthly payment. Based on the monthly timing of the payment to the loan, employees should reach out to their Loan Service Provider to better determine how the payment will be applied (e.g., principal versus interest).

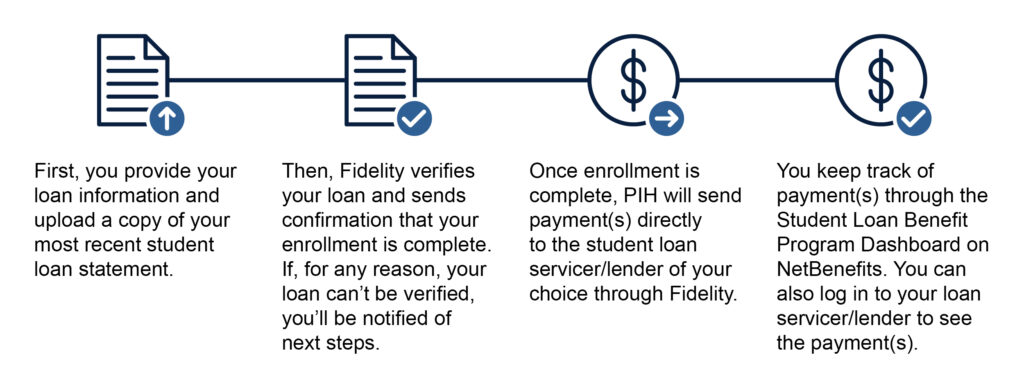

It’s easy to get started.

|

Employee Eligibility:

- Employees eligible to participate in the Program

- All hourly & salary employees, following on the first of the month 60 days after hire

- Rehired employees–prior payments will count towards lifetime

- Employees making $130,000 or less per year

- Employees NOT eligible to participate in the Program

- Interns & temporary employees

- Employees on any type of leave

- Employees making more than $130,000 per year

Loan Eligibility:

- Loans covered by the Program

- Loans taken out in the employee’s name and used to pay for the employee’s higher education

- Loans taken out for schools with accreditation recognized by the US Department of Education or loans taken out for online universities accredited by recognized accreditation agencies

- Please refer to the US accreditation database for further details: https://ope.ed.gove/accreditation/

- Loans NOT covered by the Program

- Loans in default, loans that have been sent to collections, or currently do not require loan payments for any reason

- Loans taken out in someone else’s name used to pay for the employee’s education

- Loans taken out in the employee’s name and used to pay for someone else’s education (e.g., a loan taken out for a child or other family member’s education)

- Loans for incomplete degrees

- Loans for certifications (e.g., CPA, CFA, Series 7, )

Payment Structure:

For all Program-eligible employees, Phillips Infrastructure Holdings will make monthly payments until the selected loan is repaid, OR the lifetime maximum benefit is reached.

- Only one loan at a time may be selected by the employee for payment under this Program.

- For all Program-eligible employees, a monthly payment of $150.00 will be paid by Phillips Infrastructure Holdings to the loan service provider, up to a lifetime maximum of $10,000.00, OR until the loan(s) is considered repaid.

- A loan is considered repaid once the outstanding balance is below an amount equal to two times the monthly payment amount paid by Phillips Infrastructure Holdings.

- The employee must continue to make the monthly minimum loan payments to the loan service provider; the Student Loan payment is in addition to the employee’s monthly payment.

Under IRC section 127 the annual limit applies to the combined benefits under this provision including student loan assistance, tuition reimbursement, and courses of instruction. Following the provisions of the plan and guidelines of IRC section 127, this benefit will be tax-excluded as permissible by Federal, State, and local guidelines up to an annual limit of $5,250. Payments above this limit or outside of IRC guidelines (e.g., loans used for someone else’s education) will be taxable and included as part of W2 Income.

The Student Loan payment is contingent upon employee’s continued eligibility in the Program.

Service Provider:

Fidelity Investments will be the service provider that administers the Program. An eligible employee will be able to enroll and manage activity through the Fidelity online portal.

Through the Program, all employees can also use Fidelity’s online tools to help manage their student loan debt, even if they’re not eligible to receive a payment through the Program.

What to Do Right Away?

- Get your loan statement ready so you can provide the necessary information when enrollment opens. Why start now? Because locating your loan statement can be difficult. We recommend you give yourself plenty of time to find it.

- Once you have the statement in hand (or on your computer), take a moment to check it for the following information, which you need to provide during enrollment:

- Account number

- Payment mailing address

- Current total balance

If employees meet the eligibility requirements outlined on this page, they will be required to submit the required documents to Fidelity during the sign-up process. These documents will be validated to determine eligibility. Further instructions will be supplied via the sign-up email from Fidelity to eligible employees.

The employee must maintain Employee and Loan eligibility requirements outlined above for continued participation in this Program. If employee or loan status changes and the employee is no longer eligible for the Program, payment will cease under the Program.

The employee is responsible for notifying Fidelity Investments of any changes in their loans that would result in their loan becoming ineligible for the Program.

The employee is responsible for notifying Fidelity Investments if their loan becomes paid off and they are no longer eligible for continued payments. Any overpayments returned by the Loan Service Provider, to the employee must be returned to Fidelity Investments. Fidelity will credit the Employer on their next funding file.

|

DISCLAIMER:

ALL POLICIES AND PROCEDURES OUTLINED IN THIS PROGRAM ARE SUBJECT TO CHANGE OR MODIFICATION, AT ANY TIME, AT THE SOLE DISCRETION OF PHILLIPS INFRASTRUCTURE HOLDINGS.